There’s no shortage of articles and blog posts that suggest it’s critical for product managers to track metrics. This blog offers a high-level overview of why you should track certain metrics and how to connect them to your business-driven product decisions. Metrics will vary a bit by market, product category, and company size, but there are a number of common metrics every product manager should be tracking.

Ask a dozen product managers to make a list of the metrics that matter most to them (and to their executive stakeholders) and you’ll almost always see revenue appear somewhere on that list. Product managers are usually developing products as part of a business after all, so it’s not exactly a mystery that revenue tracking is an important part of the product process. But, that being said, it’s not always clear how to connect revenue to product strategy, features, and user stories. So, how can product managers most effectively tie revenue to other product metrics and their overall product strategy?

First, determine what your business goals are. In order to effectively build a product strategy, you need to understand your organization’s business goals. Are you targeting new customers this year? Are you focusing on growing existing business? Or, are you trying to retain the business you have? Once there’s alignment on the type of revenue you’re going after, it’s your job as product manager to figure how you can move the needle.

Let’s say you’re a software company targeting new business.

If you’re looking at growing revenue from new customers, you’ll want to look carefully at your conversion rate. One way to increase new customer revenue is to improve your conversion rate. For companies that use a trial model like ProductPlan, a first step could be to break down your conversion process into different pieces: finding out about a trial, signing up for a trial, using the app during the trial, and converting or purchasing a plan. This is a fairly simplified version of a customer journey through a trial, but it helps illustrate how to break the overall process into smaller, more discrete components.

Once it’s broken down a bit, you can use your product manager prioritization skills to determine which part of the process has the most potential to make an impact. Questions you might raise around each stage of the prospect’s journey:

- Finding out about a trial: Are the product and marketing teams in sync about who exactly the prospect persona is? Are we accurately and clearly communicating the value and functionality of the product in marketing materials?

- Signing up for a trial: Is it easy to sign up for a trial? Are there UX barriers to registering, i.e. too many steps? Where can we streamline?

- Navigating the app during the trial: What is usage like during the trial for prospects that convert? Are there behavioral trends among those that buy? Why are they seeing value where others aren’t? Are there specific in-app actions that correlate with conversion? Can we do anything to drive those actions for prospects? On the other hand, is there a particular action users seem to stall on? Do they abandon the trial after trying to use X capability?

- Conversion: Is it easy to convert? Is the button to purchase a plan visible? Are there any apparent barriers to purchase? Does your app crash during half of all purchases?

Depending on the specifics of your particular sign-up process, you’ll likely gravitate toward a different part of the journey. Product managers in general might be most comfortable working on the second half of the journey, given its focus on in-product behavior, but the first half represents a great opportunity for product and marketing to collaborate and check their alignment. Brainstorming questions like these can help identify potential areas of optimization and get you started building hypotheses around new customer revenue.

Download The Product Strategy Playbook ➜

What if you’re trying to grow existing business?

You’ll want to start by benchmarking metrics like Monthly Recurring Revenue, Annual Recurring Revenue, Average Revenue per User (ARU), and Lifetime Value to give you a good sense of your product’s current performance across your existing base.

Once you’ve established your starting point, start thinking about your specific business model and pricing strategy. Do you charge users based on the number of licenses, number of administrators, or individual users? Let’s say it’s based on number of licenses. Set a benchmark for average number of licenses, then segment your customers into groups who are above and below that average. You can then further segment your successful, above-average customers by which features they are using to identify features that generate the most revenue. Once you’ve done this, you can work on getting your below-average license customers to utilize those features more heavily. Maybe they need to be more obvious to new users. Maybe there needs to be more training around them. Try to encourage usage of whichever features correlate with the highest revenue and work your way down.

In addition to this segmentation-by-feature approach, you can also operate from the assumption that if you make it easier for customers to add additional licenses themselves, they will do so. Can you make it easier, from a product perspective, for users to invite other users to the application? Is it clear to users that they can invite other users? Is it a cumbersome process to add users and purchase additional licenses. Are there any roadblocks or UI issues you can tackle? You’re in trouble if customers aren’t adding licenses because it’s too difficult to do so.

Attempting to grow existing customer revenue is also a great opportunity to conduct some customer interviews. If you’re looking to grow current business, you need to understand who is using your product, what problems they’re trying to solve, what their hang-ups are, and whether or not the product is priced appropriately. You might find that customers would pay significantly more if you added one or two simple features. This might sound implausible at first, but a couple of relatively small features might be enough to displace another tool or two they’re currently using. Add the feature, displace the other tools, and capture more revenue from your existing customers.

What about retention and churn?

If you’re focused on protecting revenue from your existing customers, you’ll want to look at a combination of retention, churn, Net Promoter Score (NPS), and product usage data. Benchmarking your current retention and churn rates will give you a starting point and help you tie your strategy to its eventual outcomes.

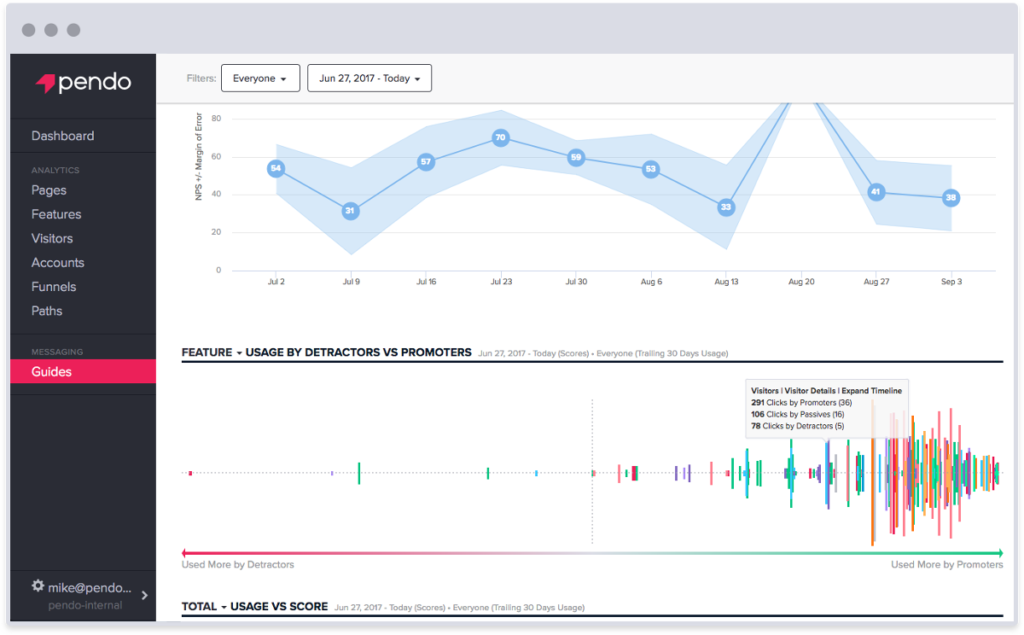

You can track your NPS score over time with a tool like Pendo. Pendo also allows you to track which features are utilized by promoters and detractors.

NPS is a helpful metric for all of the above scenarios, but the qualitative feedback from NPS surveys can be especially helpful when you’re focused on improving retention and reducing churn. If you’re trying to maintain existing revenue and reduce churn, NPS can help you figure out why customers are staying or leaving. If your NPS reveals customers are leaving because they’re dissatisfied with the UI or because they “just aren’t using your product very much,” then you can prioritize development efforts to target those issues.

It’s best to focus resources around feedback that is actionable and can be broken down into concrete development activities. For example, it’s preferable to tackle a specific, frequently-cited UI issue that can be addressed with a reasonable amount of effort—like taking a commonly-used button out of a deep sub-menu and making it easier to get to—than to tackle less tangible feedback around the “feel” of your product. The benefit here is that you can easily track that button’s usage before and after that update and connect that to your NPS score.

If customers are churning because of low usage, then you’ll want to identify areas where you may have missed the mark—maybe you didn’t clearly expose a new feature or streamline a certain workflow—and then try to increase how much time they spend in your product. You can approach this issue from a number of directions. You could look to your successful, high-usage customers and figure out which actions and behaviors they’re exhibiting, and try to encourage and replicate those behaviors in your would-be churners before they leave.

For example, your high-usage customers may have integrated your application with a number of their other apps and services. If it’s easy for them to access data from their CRM app, for instance, without exiting your app, they might be more likely to stay in your app for longer periods of time. If this hypothesis seems accurate, you can prioritize development efforts around building out additional integrations. As a bonus, this might expose you to new customers (the users of the other apps) at the same time it helps you increase stickiness, active sessions, and retention.

Beyond focusing on the integration hypothesis, you can look at patterns of other product-specific actions your successful customers perform and try to encourage those behaviors and actions in your low-usage customers. At ProductPlan, our product team might be interested in how many product roadmaps users create and share, on average. Say, hypothetically, we noticed our churning customers had created less than two roadmaps and had shared those roadmaps with less than three other viewers.

On the other hand, our hypothetical high-ARU customers, on average, have created more than three roadmaps, with at least three shares per roadmap. We could use this data to focus activities on a segment of users where “# of roadmaps < 3 AND # of shares < 3.” We might develop a hypothesis that went something like “If we make it easier to create and share roadmaps, we can reduce churn.”

Our product team might approach this by updating the UI to make creating roadmaps even easier, improving the UX of sharing a roadmap with other team members, or making it easier for those team members to further share the roadmap. Product might also work with customer success and marketing to target that segment of customers with additional support docs, how-to videos around creating and sharing roadmaps, and other resources, to ensure these users are aware of these features and comfortable using them.

____

Whether you’re going after new revenue, growing your existing customer revenue, or attacking churn, product managers can follow the same basic formula. Identify your specific business goal, identify which metrics will be used to define success criteria and inform strategy, construct a hypothesis that combines your observations about customer behavior, product usage, and your data, and start planning your next development sprint. Remember to update your product roadmap as you adjust your strategy.

Don’t get too bogged down in the data. Don’t build enormous spreadsheets with thousands of data points. Product managers are great problem solvers and typically have excellent pattern recognition skills. If you can identify some usage patterns in your successful customer base, there’s a good chance encouraging those behaviors in your low-usage, soon-to-churn customers is a smart move.

Metrics and data alone won’t guarantee success or result in a concrete product strategy. But, slicing up specific data across specific customer segments with specific business goals in mind is a solid approach to constructing an actionable hypothesis with the potential to move the revenue needle in a significant way.