Competition is healthy. If your product doesn’t have any competitors, it won’t have too many customers, either. An attractive market opportunity always entices many parties to take a crack at it. But how to product managers research competitors, how do they keep up?

Product managers view competitors as a double-edged sword. Yes, they are likely going to grab some of your potential market shares and make it harder to close as many deals. But, competition pushes your product to reach its potential. They inspire new features and enhancements you may not have thought of, and bring out the best in you and your colleagues.

Regardless of how much time and energy you spend tracking and analyzing the competition, they will continue to innovate. Their functionality, messaging, pricing, and product positioning will evolve constantly. Your customers and prospects will hear those pitches and entertain the pros and cons of each solution available to them. So it’s best to keep a close watch on what they’re all up to and figure out how to share and potentially act on what you’re seeing. Product Managers research competitors not only to keep up on the landscape but also as an inspiration to push their team forward.

How Product Managers Keep Tabs on Competitors

You can’t make informed strategic decisions on your product if you don’t know what’s happening. That’s why product managers researching competitors need a consistent approach to monitoring what everyone else is up to.

This begins by determining who should be considered a competitor at all. Sometimes it’s obvious. Especially in more mature markets where established providers of similar solutions exist.

For example, auto manufacturers know they’ve got to track what the likes of Toyota, Ford, Fiat, and Honda are up to. That club’s membership rarely changes much. However, upstarts do emerge. Such as Tesla establishing a new beachhead with luxury electric vehicles. Or Korean brands such as Hyundai and Kia entering the U.S. market 30 years ago.

There’s indirect competition from alternative solutions to the same problem. This includes motorcycles, scooters, on-demand rentals such as Zipcar, ride-sharing services like Uber and Lyft, or even public transportation. They’ll all get you from Point A to Point B, which is the primary reason people buy cars.

For technology companies, understanding current markets requires customer research. Plenty of startups who found their problem-solving apps were no match for workarounds prospects had devised.

1. Keep Up on Competitive Product Research

After compiling your list of competitors, product teams must ensure they’re getting a steady stream of intelligence on what they’re up to. You could set a bunch of calendar reminders to check their websites once a week. However, a more automated, passive system is more prudent for a product manager researching competitors with other tasks on their plate.

To ensure you’re not missing out on what’s new and exciting, you’ll need to act like a superfan of these products:

- Subscribe to their newsletters

- Follow them on social media

- Read their blog posts

- Watch their webinars

- Set up Google Alerts for their products

- Follow relevant industry analysts

- Track product reviews

You might want to use alternative social media handles and email addresses. In order to not make it too obvious what you’re up to. Getting bombarded by their messaging will not only give you a heads up on what they’re working on, but you’ll also see how they position their offering. An added benefit can be seeing what their customers are saying when they comment on posts or “@” them on Twitter.

3 steps to keep track of product competitor research

All that information is great. But with no organized strategy for dealing with it all, it can become overwhelming and useless. Don’t think you can remember it all and come up with a plan to manage the inflow and do something useful with what you’re learning.

1. Divide and conquer.

Assuming you have the luxury of product team, product managers research competition by splitting up which companies you’re each going to track. This is a better approach than divvying things up based on channel. This way individuals will get a holistic view of what a given competitor is up to.

You can each become mini-subject matter experts on your assigned rivals. When a new alternative appears on the horizon, they can be assigned to someone specific for tracking.

2. Define what you’re tracking.

You don’t need to know everything about your competitors, only the important stuff. To create a consistent competitive analysis approach, figure out what key elements you should note and what to skip.

Your top topics might be:

- Major new features

- Third-party integrations and partnerships

- New marketing campaign themes

- Major new customer announcements

- Pricing and packaging changes

- Financial news (new funding announcements, earnings reports, sales figures, etc.)

- Key hires and departures

3. Organize your insights.

What is important for product managers researching competitors is consistency. It doesn’t matter if you opt for a competitive intelligence dashboard or a shared Google Doc. You need to find the relevant information you’ve gleaned from your research so if someone asks you what’s new with Company X or the value proposition of Product Y quickly.

Likewise, if you’ve taken the divide and conquer approach, you should each be using the same format and criteria.

2. Create a Comparison Matrix

With your competitors identified and your information collected, there’s no better way to see how everyone stacks up than via a matrix. At a glance, you should be able to make a comparison. This should include features, platform compatibility, integrations, industries, verticals, key customers, and pricing.

This isn’t going to include every detail and nuance. The ability to see a snapshot is a handy resource. Anyone trying to get a feel for the marketplace can see the key differences between solutions.

3. Build Out Your Battle Cards

Product managers researching competitors need a strategy on how to win. Battle cards are a tried-and-true tool for visualizing the competitive landscape. There are a few different versions. They’re all a take on one-pagers that creates a visual template for putting competitive intelligence into action.

Each competitor can have its own battle card. These should spell out everything from pricing to their strengths and weaknesses. It’s a quick reference for the latest take on what they have to offer.

You can also create comparison battle cards. Line up your current product offering and a competitor’s. This allows you to compare how you differ, where you overlap, and which variances are opportunities or weak points in the juxtaposition between the two.

Battle cards can play multiple roles for your organization. For the product team, it can serve as another tool to spot opportunities where you can shore up your product offering or areas where you’re currently leading and may want to build on.

But the sales and marketing teams can also benefit from them. They provide a concise reference for competitors. They can also be “played” during sales training and prep work to create a unique selling proposition.

For example, let’s say a salesperson is calling on a prospect that currently uses a competitor’s product. Using battle cards, they’ll be able to know in advance which areas your own offering is better at, as well as the things your competitor does better. This will allow the salesperson to better prepare their pitch and not be surprised when things come up during the meeting.

In some cases, marketing might even produce battle cards. These cards can highlight the areas where your product is superior to prospects. These can also be used defensively if a current customer is considering a switch to an alternative.

4. Share Competitive Intelligence Updates

It can be really tempting to fire off emails the second you find a juicy tidbit about your competitors. You want to be seen as someone who’s on top of the news and don’t want anyone else to steal your thunder.

Stakeholders aren’t looking to product management as a source of gossip or to be a news aggregator. They’re looking for actionable information, and that includes analysis and context beyond the headline. This is why it’s so important for product managers to research competition.

Come up with a manageable cadence for updating stakeholders on noteworthy news and stick to it. This could be daily, weekly, or monthly given how active your particular industry is, but less is often more in these cases.

When you do deliver these updates, be sure you’re providing more than just a bunch of links. Briefly describe what you’ve learned, why it’s important, and if there’s any recommended action, including how this may impact the cost of delay.

Competitors will launch new features, sign new customers, and create news about themselves all the time. That’s how they stay relevant and top-of-mind, and your marketing department is likely doing the same thing. So be sure you’re adding value by curating carefully and providing substantive analysis. This is a handy tool to go with what you do choose to share and to help avoid stakeholders succumbing to shiny object syndrome.

Of course, there may be exceptions to the rule. When Google acquires a competitor or Amazon announces they’re entering your market you shouldn’t wait for your scheduled update. But keep those “urgent alerts” to a minimum to preserve your credibility and make sure you’re not tuned out by busy executives.

Regular reviews and overviews

Beyond breaking news, it’s always a good idea to take a step back and holistically review your overall assessment of each major competitor. Whether it’s monthly or quarterly, go back and review their current messaging and offering compared to what’s in your matrix and battle cards.

This “forest versus trees” analysis might uncover a trend you’d missed. Plus it’s just a good exercise to renew your familiarity with whom your product is up against.

5. Turn Competitive Intelligence Into Action

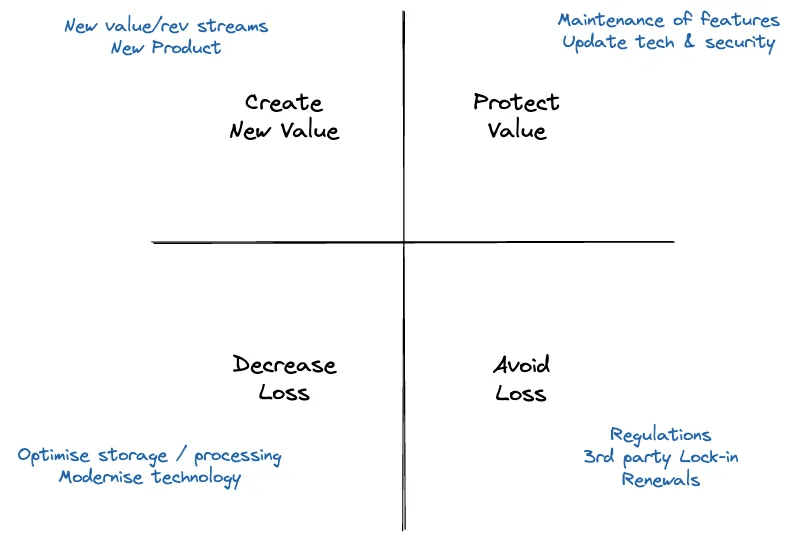

Compiling, organizing, and sharing all this data is pointless if it’s not going to inform the actions of your team and your organization. Be sure a competitive analysis is always an initial part of any decision-making or prioritization activity. And while competition shouldn’t be the only driver for what makes it onto the roadmap, it can’t be ignored either.

Understanding what else is out there is crucial to figuring out what differentiates your product versus what it is sorely lacking. Addressing the latter will let buyers focus on the former instead of fixating on what your product doesn’t do.

Remember, just because your competitor is doing it doesn’t mean you necessarily need to do it as well and just turn into a feature factory. The secret to an effective product strategy is doing a few things well and becoming invaluable to some of the markets versus doing the bare minimum to keep a broader swath of prospects potentially interested.