What Does Turnover Rate Mean?

For a product or marketing team, turnover rate refers to the percentage of customers lost over a period of time. For a SaaS company, the turnover rate will include both customers who actively cancel their subscriptions and simply don’t renew them. Many businesses refer to the customer turnover rate as churn.

Note: You can also think of the turnover rate as the opposite of your company’s customer retention rate.

Why Is Turnover Rate an Important Metric?

Customer turnover can tell a business a great deal about how well its products perform in the market. Here are a few specific reasons turnover is a metric worth tracking and analyzing.

It signals whether or not your products are earning a loyal user-base.

If a product team examined only its products’ annual revenue and the total number of new customers in a given year, the team would have only part of the story.

To determine if it resonates with users, a business needs to know how many customers are sticking with the product over the long-term. Turnover rate is a key performance indicator (KPI) because it tells a business exactly what percentage of its customers find the product valuable enough to continue paying.

It gives you a better picture of your product’s profitability.

According to research cited in the Harvard Business Review, it can cost a business between five and 25 times as much to acquire a new customer as it costs to keep an existing one.

That means that retaining customers—in other words, keeping your turnover rate as low as possible—is a key strategy for increasing your products’ profitability. If your team does not track and review your turnover rate, you will be missing an important data point to determine whether or not your profits have long-term profit potential.

It tells you whether or not your customer-acquisition strategies are effective.

A high rate of customer turnover can indicate several things. For example, the product might not resonate with its intended users, or the company’s customer-acquisition strategies are somehow missing the mark.

Let’s say your team spends a lot of money on a marketing and sales campaign that targets a particular customer segment. Many new customers sign up for your product, but then quickly end their subscriptions. This would indicate something is off—either the product fails to solve your persona’s problems, or there is a misalignment between your product’s promise and the user segment you’re targeting.

If your marketing efforts continue to bring in new customers, and you’re not also monitoring turnover, you might not realize that there is a problem with your customer acquisition process. This is another reason tracking your customer turnover rate is essential.

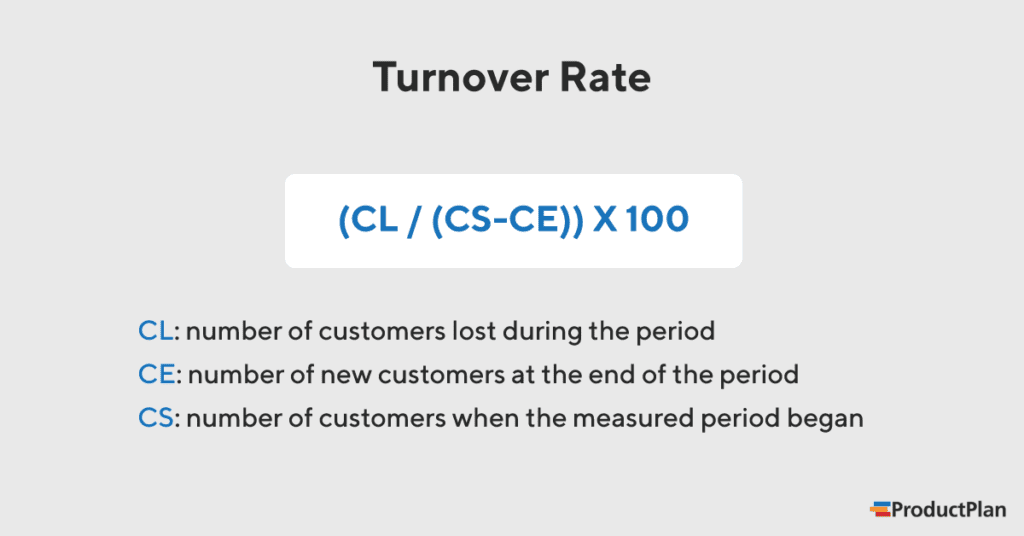

What Turnover Rate Formula Should We Use?

To calculate the customer turnover rate over a given period—let’s use one year—you will need three data pieces:

1. Your total customer count on day 1.

2. The number of new customers you acquire during the period.

3. The number of customers you lose during the period.

(Note: The lost-customer figure should include both active cancellations and customers who simply don’t renew their subscription.)

Here’s what the formula looks like:

A turnover rate example

Let’s say your company sells a B2B software app on an annual subscription basis. Here’s how you would plug in the data above to determine your customer turnover rate for a given year:

- You had 3,109 existing customers on January 1.

- You acquired 287 new customers between January 1 and December 31.

- You lost 131 customers during the same one-year period.

Following the formula above, you perform the following two steps:

Step 1:

3,109 (total on day 1) + 287 (newly customers) – 131 (existing customers lost) = 3,265.

Your new total count as of December 31 was 3,265 active customers.

Step 2:

131 (existing customers lost) / 3,265 (new total customer count) = 4%.

Your customer turnover rate for the year in question was 4%.

Related Terms

churn / retention / customer acquisition cost (CAC) / monthly recurring revenue (MRR) / lifetime value (LTV)